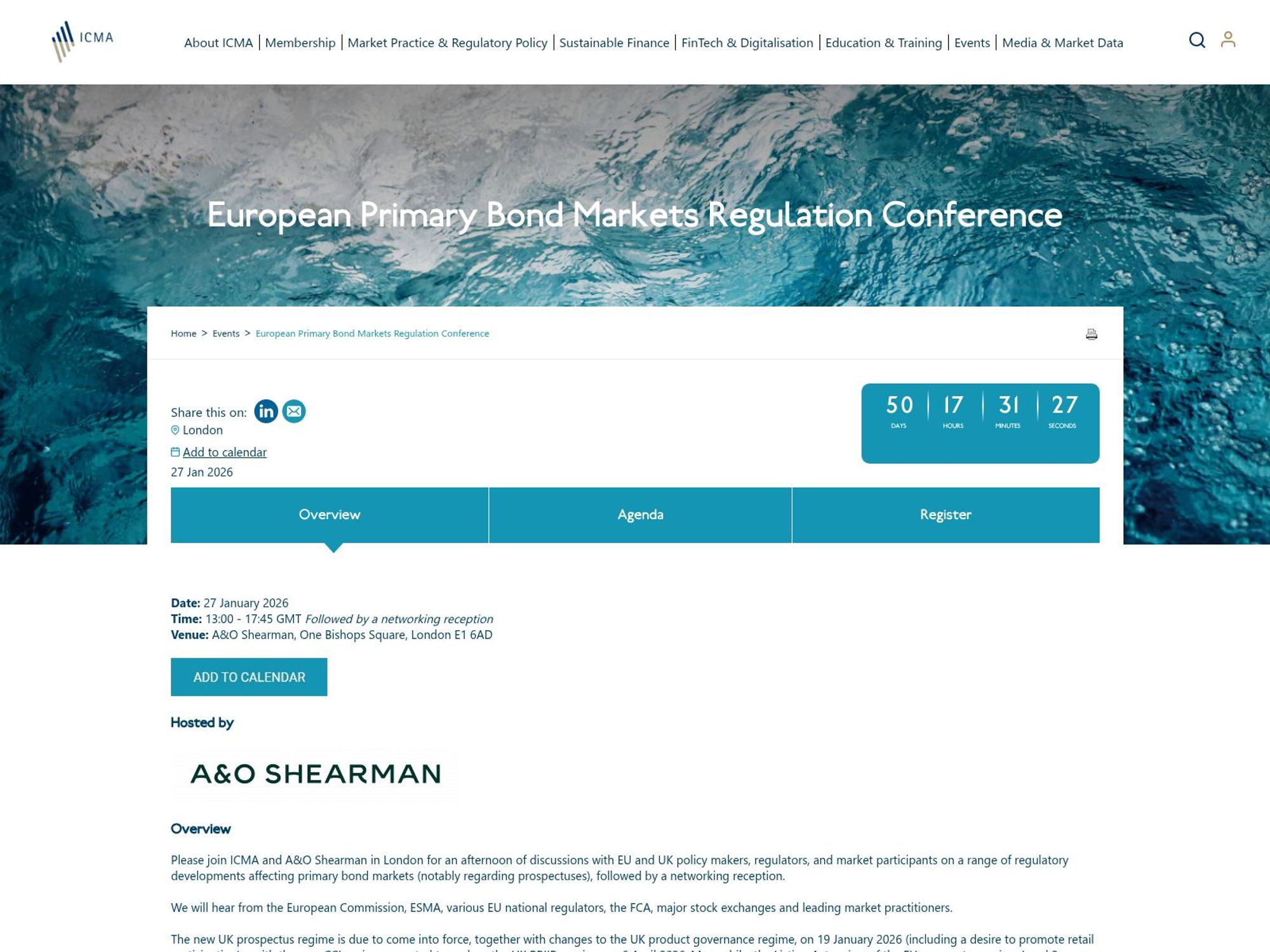

European Primary Bond Markets Regulation Conference

🇬🇧 London (United Kingdom)

Description

Please join ICMA and A&O Shearman in London for an afternoon of discussions with EU and UK policy makers, regulators, and market participants on a range of regulatory developments affecting primary bond markets (notably regarding prospectuses), followed by a networking reception.

We will hear from the European Commission, ESMA, various EU national regulators, the FCA, major stock exchanges and leading market practitioners.

The new UK prospectus regime is due to come into force, together with changes to the UK product governance regime, on 19 January 2026 (including a desire to promote retail participation) – with the new CCI regime expected to replace the UK PRIIPs regime on 6 April 2026. Meanwhile, the Listing Act review of the EU prospectus regime Level 2 provisions is now at an advanced stage stage (with a Commission consultation anticipated in the first quarter of 2026) and the Retail Investment Strategy review of the EU MiFID investor protection and PRIIPS regime Level 1 provisions may be reaching the final stages of trilogue negotiations. The EU’s new Savings and Investment Union project is also emerging, with any potential implications for the primary bond markets remaining to be seen.

This event will be held under the Chatham House rule.

Admission: This in-person event is free to attend and open to ICMA members and interested market participants.

Categories

Format: Conference

Topic: Finance, Fixed Income, International Capital Market Association, Financial Regulation

Distribution: in-person

Talk language: English

Ticket cost: Free access